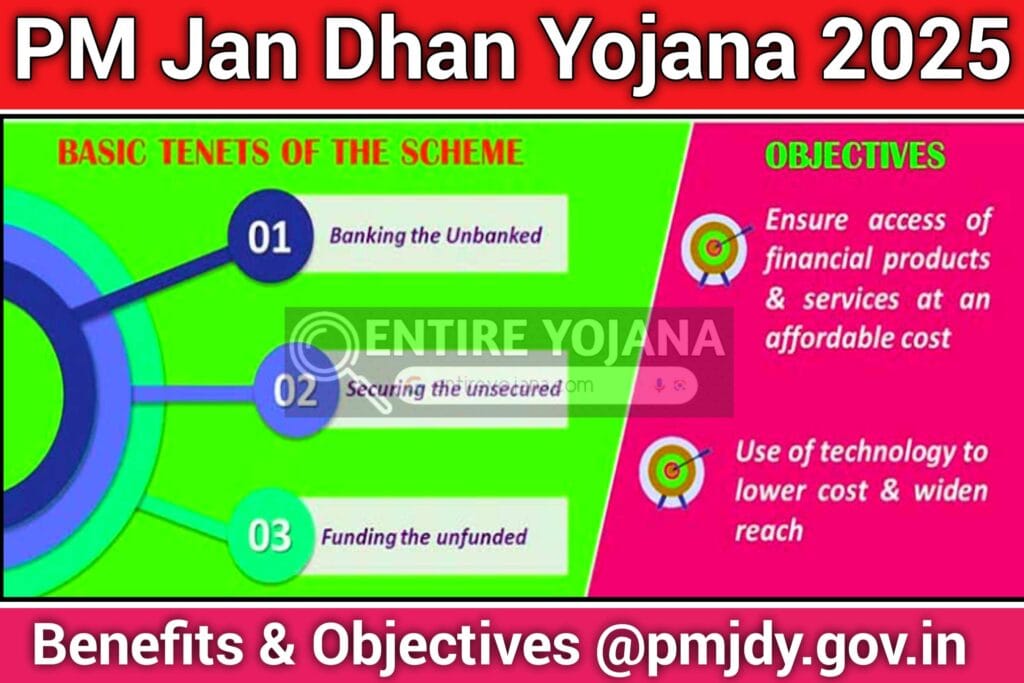

PM Jan Dhan Yojana 2025: Pradhan Mantri Jan Dhan Yojana, launched on 28 August 2014 is a financial scheme by the government of India. It’s main objective is to provide universal access to banking facilities. A number of population is living in slum areas which have no access to digital transactions. This scheme aims to target the unbanking and underprivileged sections of society. The beneficiaries can open the zero balance savings accounts, which come with a rupay debit card, accidental insurance cover etc. As per reports, over 462 million + accounts have been opened, rising deposit to ₹1.72 trillion. Pradhan Mantri Jan Dhan Yojana remains a key initiative financial literacy, providing the direct bank transfer of subsidies and reducing the dependence of physical visits. For more information read the complete article.

PM Jan Dhan Yojana 2025- Overview:-

| Organization | Pradhan Mantri Jan Dhan Yojana (PMJDY) |

| Category | PM Yojana |

| Objective | Financial inclusion and universal access to banking services |

| Key Features | – Zero-balance savings accounts – RuPay debit card – Accidental insurance cover of ₹2 lakh – Overdraft facility up to ₹10,000 |

| Target Audience | Economically weaker sections, unbanked population |

| Benefits | – Direct Benefit Transfer (DBT) – Access to formal banking channels – Financial literacy programs |

| Achievements | – Over 462 million accounts opened (as of August 2022)- Deposits exceeding ₹1.72 trillion |

| Insurance Coverage | Life insurance cover of ₹30,000 (for accounts opened within the first year) |

| Official Website | pmjdy.gov.in |

| WhatsApp Group Link | JOIN NOW |

PM Jan Dhan Yojana Eligibility Criteria:-

The Pradhan Mantri Jan Dhan Yojana (PMJAY) Eligibility Criteria is as follows;

- Any Indian citizen aged 10 years or above is eligible to open an account under this scheme.

- Insurance benefits are available only to individuals aged 18 to 59 years.

- The scheme is target at economically backward individuals without existing bank accounts.

- Excluded groups:

- Government employees (central and state).

- Retired employees from central or state governments.

- Taxpayers.

- The primary objective is to provide banking access to unbanked individuals who were previously exclude from formal financial services.

PM Kisan Rejected List 2025 Reasons & Solutions

Documents Required:-

The PM Jan Dhan Yojana Required Documents are as follows;

- Aadhar Card

- ID Proof (e.g., Voter ID)

- PAN Card

- Driving License

- Passport Size Photo

- Mobile Number

- Permanent Address Proof

Restrictions – PM Jan Dhan Yojana:-

| Deposit Limit | Maximum deposit of ₹1,00,000 per financial year. |

| Maximum Balance Limit | Maximum account balance of ₹50,000. |

| Withdrawal Limit | Maximum withdrawal of ₹10,000 per month. |

| Document Verification | If restrictions are not followed, account is valid for 12 months; documents required thereafter to keep it active. |

Benefits of Pradhan Mantri Jan Dhan Yojana:-

There are various benefits of Pradhan Mantri Jan Dhan Yojana, here are some key advantages;

- Account holders do not need to maintain a minimum balance.

- A free RuPay Debit Card is provided for ATM withdrawals and payments.

- Accidental insurance cover of ₹1 lakh and life insurance of ₹30,000.

- Overdraft facility of up to ₹2,000 within six months.

- Micro credit of up to ₹5,000 for regular account use.

- Direct benefits of government schemes credited to the account.

- Loan facility of up to ₹10,000 without documentation.

Rail Kaushal Vikas Yojana 2025 Apply Online, Eligibility & Benefits

Steps to Apply Online For PM Jan Dhan Yojana 2025:-

- Visit the nearest bank branch.

- Get the application form.

- Fill in the required details.

- Keep the required documents ready.

- Submit the form and documents to the bank.

- Complete the bank formalities.

- Your account will be activated once approved.

Important Links:-

| WhatsApp Group Link | JOIN NOW |

| Official Website | CLICK HERE |

FAQs:-

What is main objective of Pradhan Mantri Jan Dhan Yojana?

The main objective of PMJDY is financial inclusion and universal access to banking services.

What is life insurance coverage under PMJDY?

Under PMJDY the life insurance cover of ₹30,000 (for accounts opened within the first year) is provided.

Advertisement